tn vehicle sales tax calculator wilson county

Tennessee State Sales Tax. The Wilson County sales tax rate is.

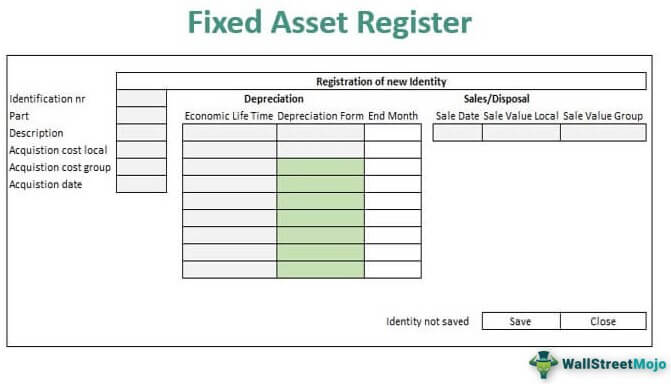

Fixed Assets Register Definition Format How To Prepare

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. Vehicle Tax Calculator Please note an additional 200 is required for transactions via mail. The county the vehicle is registered in. Vehicle Sales Tax Calculator.

The current total local sales tax rate in Wilson County TN is 9750. The 2018 United States Supreme Court decision in South Dakota v. The following information is for Williamson County TN USA with a county sales tax rate of 275.

Heres the formula from the Tennessee Car Tax Calculator. Maximum Possible Sales Tax. Average Local State Sales Tax.

925 Is this data incorrect Download all Tennessee sales tax rates by zip code. 15 to 275 Local Tax on the first 1600 of the purchase. Has impacted many state nexus laws and sales tax collection.

State Sales Tax is 7 of purchase price less total value of trade in. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Other counties in TN may have a higher or lower county tax rate applied to the first.

500 if a new plate is mailed. Maximum Local Sales Tax. Local Sales Tax is 225 of the first 1600.

Wilson County Jim Goodall PO. A 500 archive fee is required for new registrations and titles. Purchases in excess of 1600 an.

Dekalb County James L Jimmy Poss. Vehicle Sales Tax Calculator. Wilson County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Wilson County totaling 225.

7 State Tax on the sale price minus the trade-in. Smithville TN 37166 Phone. This amount is never to exceed 3600.

Tennessee has a 7 statewide sales tax rate but. The December 2020 total local sales tax rate was also 9750.

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Georgia Used Car Sales Tax Fees

Evidence From Current County Reappraisals

Failure To Launch Measuring The Impact Of Sales Tax Nexus Standards On Business Activity Sciencedirect

Morristown City Council Approves Adjusted Tax Rate Local News Citizentribune Com

Tennessee County Clerk Registration Renewals

Inside The Plan To Pay For Nissan Stadium S New Campus

Tennessee County Clerk Registration Renewals

Kansas Sales Tax Rates By City County 2022

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Sales Tax Rate Rates Calculator Avalara

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Vehicle Services Division Ppt Download

State Of Tennessee Cumberland County